What Do Know If Everything is Ok with My Installment Agreement; IRS Just Sent Me CP-89.

The IRS goes through a series of notices regarding Installment Agreement, from Cold (barely on the radar) to Smoldering Hot (requires immediate attention). Check out the links to learn more:

- Form 9465 Installment Agreement Request – Not too scary (Cold).

- Form 433D – Installment Agreement- Direct Debit Payment Authorization– Still pretty cool (Getting warmer).

- Letter 2273C- Installment Agreement Acceptance. Warm, this is a good thing

- CP 89- Annual Installment Agreement Statement – Statement of payments made. Good, this means your Installment Agreement is in good standing

- Letter 2272C- Installment Agreement Cannot Be Considered. Smoldering hot—act now or lose your due process rights (your right to a hearing, reinstatement of the Installment Agreement and to stop collections)

- CP 522- We’re Reviewing Your Installment Agreement– Smoldering hot- This likely means that the IRS believes that your monthly payment should increase. You absolutely must respond.

- CP 523 – Intent to Terminate Your Installment Agreement and Seize (Levy) Your Assets– Red hot- The IRS will terminate you Installment Agreement unless you do something- act now or lose your due process rights (your right to a hearing, reinstatement of the Installment Agreement and to stop collections)

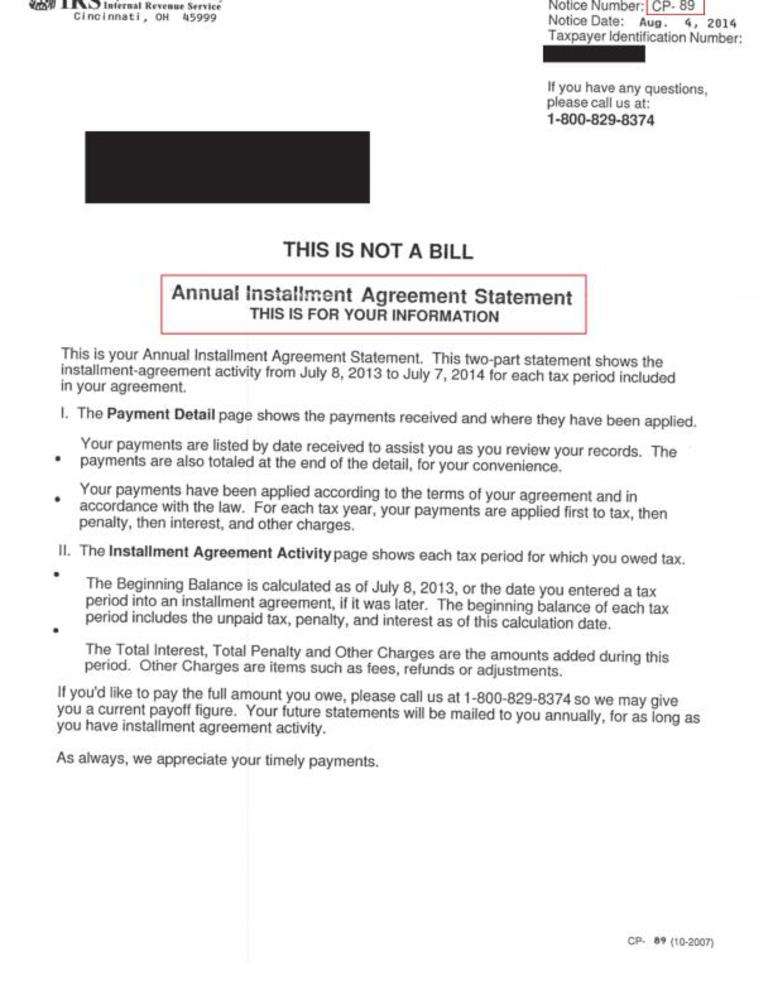

This notice is CP 89 Annual Installment Agreement Statement. Generally, the IRS sends this notice annually as a notice of the remaining balance due and statement of payments made over the last year. No response is required unless there is an error in your payment history. It is the fourth notice/form in the Installment Agreement series.

What can I expect because of this notice?

CP 89 is the payment history of the Installment Agreement over the last year. The IRS will include a page titled Installment Agreement Activity. This page does confuse some taxpayers. Most of the confusion usually comes from the fact that even through you are making payments, penalty and interest continue to accrue. These columns do not show the amount of penalties and interests added by year. They actually show the total amount of penalties and interest accrued since the debt was accessed. This is a standing balance that will increase slightly every year.

What can I expect next after this notice?

If everything goes along smoothly, you will receive another CP 89- Annual Installment Agreement Statement, indicating you are in good standing and the payments that have been made.

If the IRS detects your income has increased or they feel that they want to review your ability to pay, they will send you CP 522- We’re Reviewing Your Installment Agreement. You absolutely MUST respond to the CP 522 or your Installment Agreement will be in jeopardy of default and you will receive CP 523 – Intent to Terminate Your Installment Agreement and Seize (Levy Your Assets.

If you receive Letter 2272C, the IRS will detail the reason(s) they cannot accept your Installment Agreement.

What are my options?

What is my first step?

If you received a letter or notice, a decision must be made. Do you feel confident to handle this situation on your own? If it is a simple issue and you already know the answer, call, or write them. If the issue is more complicated, you need to hire a Certified Tax Resolution Specialist. The IRS or State will take full advantage of your lack of knowledge and experience.

What is Your Next Step?

The next step is to determine if the notice was sent in error. Do you have an outstanding tax liability? Do you have unfiled or incomplete returns?

Is There a Time Limit?

Yes! Each letter or notice from the IRS or State will indicate a date that you MUST contact them by. If you need more time, call the number on the notice or letter, and request an extension. DO NOT ALLOW the time to expire without contacting them or hiring a representative to contact them for you.

What You Don’t Want to Do!

What you don’t want to do is nothing. Your tax problems will only get worse if you ignore them. If you cannot pay, there are a number of potential solutions available to those who are otherwise in compliance. In compliance means having all tax returns filed and any balances paid or on a payment plan. If you have outstanding debts or unfiled returns, you need to get hire a Certified Tax Resolution Specialist.

Get Some Help

If you don’t know how to address the issue(s), have unfiled returns/unpaid balances or just don’t feel confident, let the experts at Legacy Tax & Resolution Services represent you. Work with our team of Certified Tax Resolution Specialists to resolve your issue(s) quickly. Best of all, you don’t have to talk to the IRS or State; we can speak on your behalf.

Stop the stress and resolve your problems Call 800-829-7483 TODAY

Download our Special Report “ I Just Received an IRS Notice, What Do I Need To Know?”

In it you will find next steps, dos and don’ts and information about your options

We Offer Financing for Our Tax Resolution Fees

Stop the stress and resolve your problems!

Call 800-829-7483 for a FREE Consultation

See our Tax Help Video Library