Why is my Installment Agreement Being Reviewed; IRS Just Sent Me CP 522.

The IRS goes through a series of notices regarding Installment Agreements, from Cold (barely on the radar) to Smoldering Hot (requires immediate attention). Check out the links to learn more:

- Form 9465 Installment Agreement Request – Not too scary (Cold).

- Form 433D – Installment Agreement- Direct Debit Payment Authorization– Still pretty cool (Getting warmer).

- Letter 2273C- Installment Agreement Acceptance. Warm, this is a good thing

- CP 89- Annual Installment Agreement Statement – Statement of payments made. Good, this means your Installment Agreement is in good standing

- Letter 2272C- Installment Agreement Cannot Be Considered. Smoldering hot—act now or lose your due process rights (your right to a hearing, reinstatement of the Installment Agreement and to stop collections)

- CP 522- We’re Reviewing Your Installment Agreement– Smoldering hot- This likely means that the IRS believes that your monthly payment should increase. You absolutely must respond.

- CP 523 – Intent to Terminate Your Installment Agreement and Seize (Levy) Your Assets– Red hot- The IRS will terminate you Installment Agreement unless you do something- act now or lose your due process rights (your right to a hearing, reinstatement of the Installment Agreement and to stop collections)

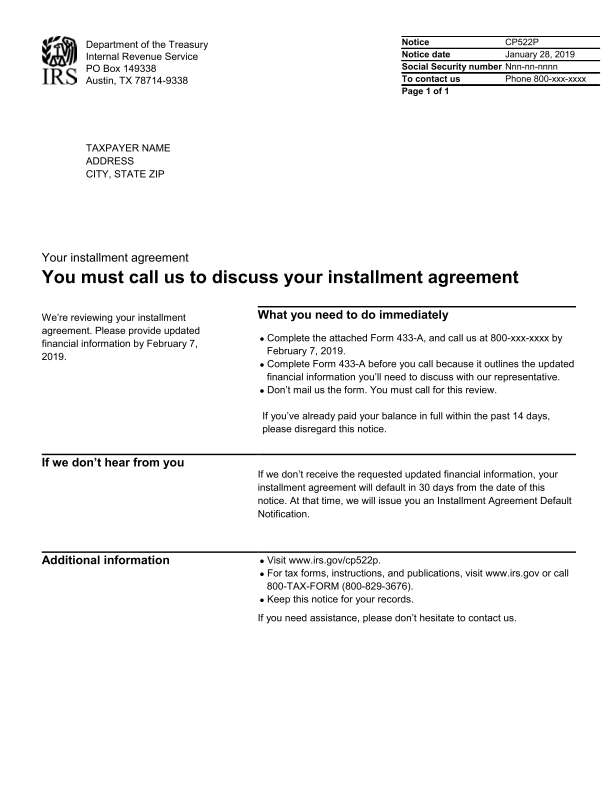

This notice is CP 522 We’re Reviewing Your Installment Agreement. Generally, the IRS sends this notice because your income has increased as seen on your tax returns or the IRS has chosen to review your case to verify the amount you can pay. It is the sixth notice/form in the Installment Agreement series.

What can I expect because of this notice?

CP 522 means they want to conduct a review of your installment agreement. The IRS will only give you 10 days to respond by threatening to terminate your agreement. IRC 6159(d) requires the IRS to review an installment agreement every two years if the amount of the payment will never pay the IRS debt in full. The IRS can also request a review of your agreement if they have information that makes them believe your income has increased, and you could possibly start paying more.

What the IRS wants is a new Collection Information Statement (Form 433F) from you to determine if they can increase the amount of your payment. First you will want to determine if you can comply within 10 days. If not, you will need to contact the IRS to get more time.

The Form 433F is the Collection Information Statement used by the IRS to compile information about your finances. You will need to be prepared to provide documents that verify the information on the 433F, including recent bank statements, paystubs, and possibly verification of your living expenses (like housing/utilities, car payments, student loans and out of pocket medical expenses).

Possible Outcome

Based on the 433F the amount can go up, stay the same, or yes, even go down.

What can I expect next after this notice?

If the IRS accepts your Installment Agreement you receive IRS Letter 2273C- Installment Agreement Acceptance. If the IRS rejects your Installment Agreement, they will send you IRS Letter 2272C- Installment Agreement Cannot Be Accepted.

If you receive Letter 2272C, the IRS will detail the reason(s) they cannot accept your Installment Agreement and your rights

What are my options?

What is my first step?

If you received a letter or notice, a decision must be made. Do you feel confident to handle this situation on your own? If it is a simple issue and you already know the answer, call, or write them. If the issue is more complicated, you need to hire a Certified Tax Resolution Specialist. The IRS or State will take full advantage of your lack of knowledge and experience.

What is Your Next Step?

The next step is to determine if the notice was sent in error. Do you have an outstanding tax liability? Do you have unfiled or incomplete returns?

Is There a Time Limit?

Yes! Each letter or notice from the IRS or State will indicate a date that you MUST contact them by. If you need more time, call the number on the notice or letter, and request an extension. DO NOT ALLOW the time to expire without contacting them or hiring a representative to contact them for you.

What You Don’t Want to Do!

What you don’t want to do is nothing. Your tax problems will only get worse if you ignore them. If you cannot pay, there are a number of potential solutions available to those who are otherwise in compliance. In compliance means having all tax returns filed and any balances paid or on a payment plan. If you have outstanding debts or unfiled returns, you need to get hire a Certified Tax Resolution Specialist.

Get Some Help

If you don’t know how to address the issue(s), have unfiled returns/unpaid balances or just don’t feel confident, let the experts at Legacy Tax & Resolution Services represent you. Work with our team of Certified Tax Resolution Specialists to resolve your issue(s) quickly. Best of all, you don’t have to talk to the IRS or State; we can speak on your behalf.

Stop the stress and resolve your problems Call 800-829-7483 TODAY

Download our Special Report “ I Just Received an IRS Notice, What Do I Need To Know?”

In it you will find next steps, dos and don’ts and information about your options

We Offer Financing for Our Tax Resolution Fees

Stop the stress and resolve your problems!

Call 800-829-7483 for a FREE Consultation

See our Tax Help Video Library